|

|||||||||

| Home - Petroleum Products - Taxation | ||

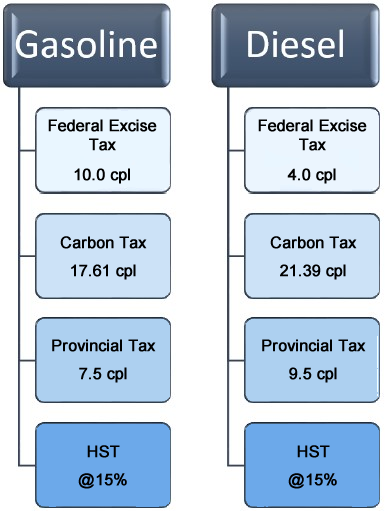

Maximum prices for gasoline and diesel motor fuels reflect both federal and provincial taxes, including the provincial fuel tax, federal excise tax, carbon tax and HST. Maximum prices for heating fuels do not reflect taxation.

|

Navigation Menu |

|